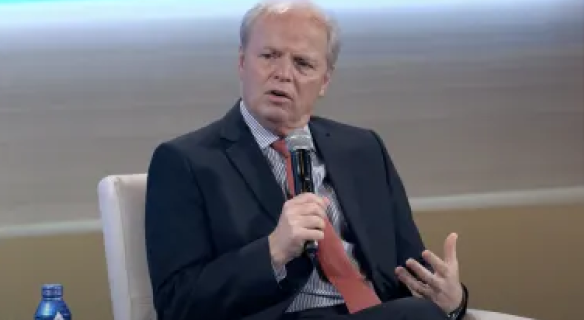

Jean-Jacques Barberis on the business case for investing in emerging markets

For years, the argument for emerging markets and developing economies was simple: Follow the yield because rates elsewhere were flat. Today, that narrative has fundamentally shifted. On the sidelines of the World Economic Forum in Davos, Jean-Jacques Barberis, head of institutional and corporate clients division at Amundi, explains why the conversation is moving beyond “risk management” toward a strategic play for diversification and scale.